If the law is passed, the tax exemption will also apply retrospectively to care premiums paid on or after November 18, 2021

The tax exemption planned by the federal government is also to include care premiums paid on the basis of resolutions by a state government. Beneficiaries would thus also be the state nursing premium in Baden-Württemberg, which the state government decided on November 11, 2021 for employees in the intensive care units of hospitals in the state

If caregivers have already received a care premium in 2021, the employer has wage-taxed this in 2021. In the printout of the electronic wage tax statement for 2021, the taxed state nursing premium is included in the reported gross wages according to line three. A separate transmission of the care premium and its amount to the tax authorities does not take place. In order for the wage tax attributable to the care premium to be refunded, the employees concerned must declare the tax exemption on their income tax return

What entries are required on the 2021 income tax return for the tax exemption?

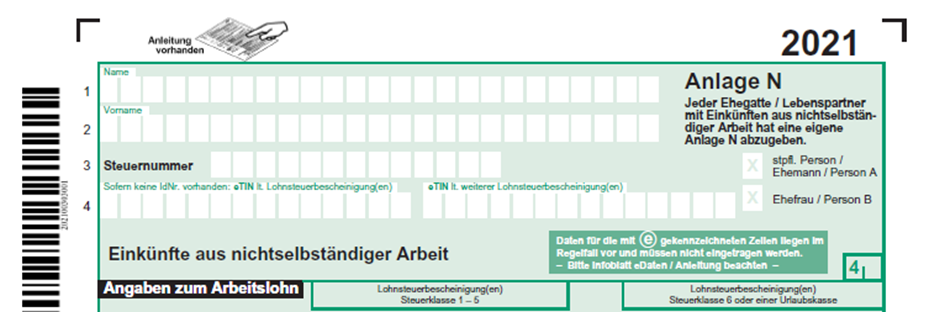

The following entry is required on Schedule N to apply the tax exemption:

You must enter the gross wages, excluding the state caregiver premium, on Schedule N.

To do this, take the gross wage according to line 3 of the wage tax certificate. From this amount, you subtract the state care premium received and enter the result on the following line 6:

![]()

Although you are generally no longer required to submit supporting documents with your tax return. If the tax office requests documentation as a result of your application, you must provide proof of the requirements for the tax exemption of the state care premium. To prove payment of the state care premium, you can, for example, submit the relevant salary statement (in which the state care premium is shown separately).

When do employees receive the tax refund?

Your tax office cannot take the tax exemption into account until the legislative process has been completed and the tax exemption has been legislated. If your tax assessment has already been issued by then, you must file an appeal against it. The tax office can then still take the tax exemption into account retrospectively

What do employees need to bear in mind in the case of care premiums in 2022?

In the case of care premiums paid by your employer in 2022, the process is simpler: In this case, the employer already takes the tax exemption into account during the monthly payroll tax deduction. Employees do not have to do anything else in this case.

What applies to employees who leave your employer in the year before the legislative process is completed?

If you receive a caregiver premium from your employer in 2022 and you leave your employment before the legislative process is completed, you must claim the caregiver premium tax exemption on your 2022 income tax return.

Where can I get more information about the long-term care premium?

For more information on the care premium Baden-Württemberg and its tax treatment, see the press release from the Ministry of Finance Baden-Württemberg and the homepage of the Ministry of Social Affairs, Health and Integration Baden-Württemberg.