Tax office Friedrichshafen

Latest news

Contact us

You need an appointment for your on-site visit to the Service Center.

Further contact options

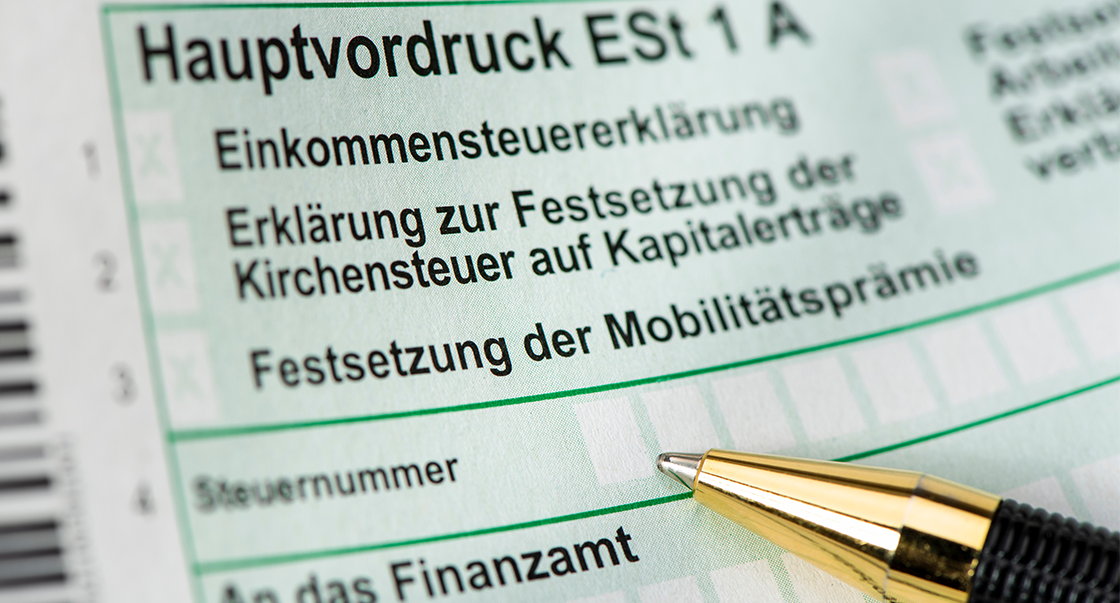

Welcome to the website of the tax office Friedrichshafen! Here you will find information on electronic tax returns, dates and explanatory videos on tax topics. For some of you, the career portal with the pages for training in tax administration and for dual studies in tax administration is certainly important. Here, school pupils can find information on the highly interesting and crisis-proof professions in our administration. Our contact persons and the Service Center will be happy to answer any further questions you may have.